NerdWallet: 12 African-American Financial Gurus to Follow in 2019

Share

Read article in it’s entirety at NerdWallet.com…

By Laura McMullen & Rick VanderKnyff | February 15, 2019

In honor of Black History Month, we asked these personal finance experts to reflect on 2019 — the questions or concerns they’re hearing, the advice they’re giving, even the moves they’re making in their own financial lives. You can also look back to the advice they gave in 2018.

Responses have been edited for length and clarity. Learn more about each financial guru below the questions.

What financial questions or concerns are you hearing in 2019?

Patrice Washington

Patrice Washington (host, “Redefining Wealth” podcast): The government shutdown earlier this year has rejuvenated conversations around why everyone should have a side gig, or at least know what their gifts are and how they’d best monetize them in the event that their consistent income was compromised somehow.

My community seems to be most concerned with learning how to earn more while maintaining a sense of purpose and balance.

Samantha Ealy

Samantha Ealy (CEO, Generation Wealthy): There have been a lot of people asking me about the best ways to start building wealth. Is it the stock market and if so, how do I easily get involved? Is it with real estate? Entrepreneurship? What are the best ways for an individual just trying to get started? When I hear these questions I always think about where the person is with their finances. What works for me may not work for you. The best next financial goal may be different for everyone, but I always recommend paying off your debt before diving into investing.

Marcus Garrett, Rich Jones (hosts, “Paychecks & Balances” podcast): We’ve heard the gamut this year from our primarily millennial audience. Concerns range from student loan and credit card debt to saving for retirement and creating additional income streams. A number of folks have become interested in entrepreneurship, real estate and active investing, which tells us that the idea of making more money in order to create the life one wants is increasing in priority and necessity. We had already planned to spend more time this year on generating additional income beyond the 9-to-5, and this jibes well with what we’ve heard from the P&B family.

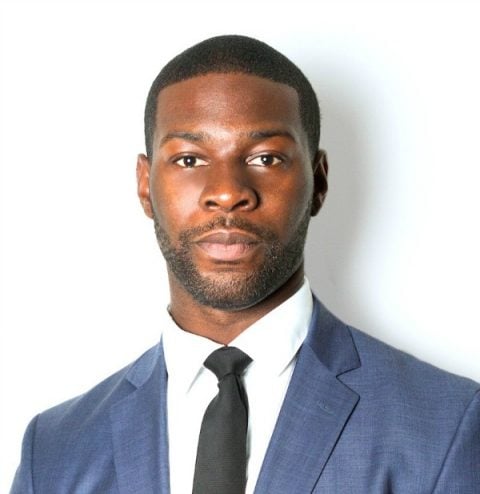

Dasarte Yarnway

Dasarte Yarnway (founder, Berknell Group): For many millennials, the later half of the year was their first experience with market volatility. So the natural question is, “What will the market do next and where should I put my money?” I like to flip that question on its head and ask, “Do you have a plan?” I think that having a plan is the only way to take the emotion out of investing, and it’s a gentle reminder to recommit to your goals when things get rough.

Kara Stevens (blogger, The Frugal Feminista): As people get older, they begin to think long-term. What does post-work look like? So, I’m getting a lot of retirement questions: Am I on track? When should I start saving? How much should I start saving? Where do I begin?

What financial topic do you wish people were talking about more?

Marcus Garrett, Rich Jones

Garrett, Jones: We wish people talked more about how good professional or career decisions can lead to good financial outcomes. For most of us, income will come from our day job and it’ll be fixed unless there’s a commission structure. And knowing that income will be fixed, what can people do strategically to put themselves in the position to make the most and (hopefully) enjoy what they do. For Rich, that meant identifying stepping-stone jobs and transferable skills that would allow him to end up where he wanted. That’s resulted in him now working for a top Silicon Valley company and more than tripling his income over the past five years. He lives in the Bay Area, so there’s a cost of living element, but these good career decisions allowed him to pay off his credit card debt and his car note two years early.

For Marcus, this has meant relocating for an opportunity and negotiating his salary upward to put him a better financial position. Additionally, companies often offer things like cell phone reimbursement, savings vehicles and discount programs that start to add up over time.

Michelle Singletary

Michelle Singletary (columnist, “The Color of Money”): I think we don’t talk enough about how people can make better decisions. And that will happen if they would explore more their relationship with money and how their past has dictated how they spend now. Many couples are fighting about their finances not just because they lack money, but because there are issues from their past that they’ve brought into their marriage. Once people understand their financial history it’s the first step into making better financial decisions.

Chris Browning

Chris Browning (host, “Popcorn Finance” podcast): Emergency funds. I think having a strong cash emergency fund is greatly undervalued. Many Americans are not in a position to handle a financial emergency of $500, which in the grand scheme of things is not that much money. The amount of stress and pressure that is removed by setting cash aside for a potential emergency is priceless. Saving up anywhere from three to six months of your necessary expenses should cover you in most situations. If you have a stable job with a low likelihood of being let go, three months can be sufficient. If you have a mortgage, kids, or uncertain or unpredictable income a six-month or larger emergency fund may be what you need.

Tarra Jackson

Tarra Jackson (blogger, Madam Money): I wish people would talk about investing and creating businesses. I consult, support and celebrate people with full-time or part-time jobs who choose to be entrepreneurs as well.

Washington: Behavioral finance as the key to shifting financial outcomes. I’m currently pursuing an MBA with a concentration in behavioral finance and financial psychology, and I wish more of my peers would share that the key is less about more information and logic and more about attaching emotion and connection to goals and a sense of purpose greater than money and material possessions.

Yarnway: I wish people talked more about planning. Although the conversation is not as sexy as stocks and investments, it is the foundation for sound investing and realizing one’s goals.

Talaat and Tai McNeely

Talaat and Tai McNeely (hosts, “His & Her Money” podcast): There most definitely needs to be much more dialogue about the importance of having proper life insurance in place. When it comes to building wealth, it is important to play both offense and defense. Debt reduction and investing are forms of financial offense and those conversations are needed as well, but we need to talk more about the defensive side of the bill. Life insurance is a form of financial defense. We don’t know when we leave this earth and we should stop pretending as though we have that figured out. We personally recommend only term life insurance as it is more affordable and it protects your family in the event of an untimely or unforeseen death. Life insurance is a tool that can be used to pass on a positive financial legacy to the generation that will come after you.

In 2019, how are you adjusting your approach to your own finances and why?

Browning: I think the older you get the farther out you start to plan. Years ago, it would have been difficult to tell you what my goals were for six months out. I think the biggest change I’ve made to my approach to my finances is planning out multiple years, and even decades, into the future. My goal isn’t to figure out the exact number I need, because life is complicated and things happen that you could never predict. My goal is to get an understanding of what my potential financial needs will be in 30 years and then build a plan that can be reevaluated each year as I continue to save and invest.

Tonya Rapley

Tonya Rapley (blogger, My Fab Finance): I’m a new mother, so my focus is even more so on ensuring my son’s financial security and my ability to retain a flexible schedule during his formative years.

Ealy: 2019 is all about making my money stretch. I’ve been in graduate school getting my MBA, so I’m not working at the moment and I’m living off savings from my past job. My budget is one of the most important tools for 2019 because if I’m not careful with my spending, I can go broke really easily. My goal is a simple one: Make a budget and stick to it in 2019, which can be easier said than done.

Washington: I’m moving soon and initially thought I would be searching for a primary residence to purchase. My husband and I have actually decided to save the 15%-20% down payment plus closing costs for now and rent in the best school district we can find for our daughter.

In the event of an impending downturn, we want to be cash-ready to purchase more investment property or buy our dream home for a fraction of the cost.

Kara Stevens

Stevens: I’m thinking about my daughter and the needs for her financial trajectory in terms of educational opportunities.

Yarnway: As my firm grows, three things that I am focused on for my own financial wellness are budgeting and controlling outflows, saving robustly and planning for future growth. In many cases, this is where many young investors should start in their financial lives.

Singletary: I’m in the phase of my life where I’m looking at retirement not too far in the distance. This means assessing my savings and expenses to be sure there’s enough to have the retirement I want. My husband and I are planning to do a deep dive into our budget to cut away what we don’t need or want. Now that our three children are coming close to finishing college (debt-free), we are ramping up our retirement savings so we can take full advantage of our higher earning years.

About the gurus

Chris Browning: Popcorn Finance

Browning is the creator and host of the award-winning, short-form podcast “Popcorn Finance.” Each week he discusses finance in about the time it takes to make a bag of popcorn. Chris holds a bachelor’s degree in finance with an emphasis in financial planning. Twitter: @PopcornFinance

Samantha Ealy: Generation Wealthy

Ealy created Generation Wealthy, a nonprofit website that produces financial education content, to break the taboo of talking about money. Inspired by her own money mistakes in college, the site promotes basic financial literacy. Twitter: @GenWealthy

Marcus Garrett and Rich Jones: Paychecks & Balances

Jones and Garrett run the “Paychecks & Balances” podcast for millennials interested in making money, saving money and getting out of debt. They leverage their experiences to provide entertaining insights and helpful tips on money management, professional growth, and other topics relevant to 20- and 30-somethings trying to get ahead. Twitter: @PayBalances

Tarra Jackson: Madam Money

Jackson runs the Madam Money blog. She is the author of “Financial Fornication,” an international speaker and a personal finance media contributor. Twitter: @MsMadamMoney

Talaat and Tai McNeely: His & Her Money

Talaat and Tai run the “His & Her Money” podcast, aimed at helping married couples navigate their financial lives. The couple paid off more than $30,000 in debt together, then paid off their $330,000 mortgage in just five years. Twitter: @HisandHerMoney

Tonya Rapley: My Fab Finance

Rapley’s blog, My Fab Finance, helps millennials break the cycle of living paycheck to paycheck so that they can create lives they love. She is the author of “The Money Manual.” Twitter:@MyFabFinance

Michelle Singletary: The Washington Post

Singletary writes “The Color of Money” for The Washington Post, a weekly personal finance column that appears in dozens of newspapers across the country. She is also the author of three books on personal finance, including “The 21 Day Financial Fast.” Twitter: @singletarym

Kara Stevens: The Frugal Feminista

Stevens chronicled her experience paying off $65,000 in debt on her blog, The Frugal Feminista. She uses her blog as a platform to teach women of color how to manage their finances. Twitter:@FrugalFeminista

Patrice Washington: Redefining Wealth

Washington got her start as a personal finance expert, “America’s Money Maven,” having success with her “mindset approach” to personal finance. She has since expanded her brand and mission, encouraging women to chase purpose, not money. Twitter: @SeekWisdomPCW

Dasarte Yarnway: Berknell Group

Yarnway had a bright future as a running back for University of California-Berkeley’s football team, until an injury made him reconsider his career path. He studied finance, worked at investment firms and banks and eventually decided to open his own advisory group. Yarnway is also the author of the book “Young Money” and host of a podcast by the same name. Twitter: @DasarteYarnway

Follow Us